The $500 Billion Stargate, boardroom hesitations, and the widening intelligence gap between legacy giants and tech-native newcomers.

There’s a curious trend unfolding in the corporate world, and it’s not just about buzzwords or investor decks. It’s about AI—and who’s afraid of it.

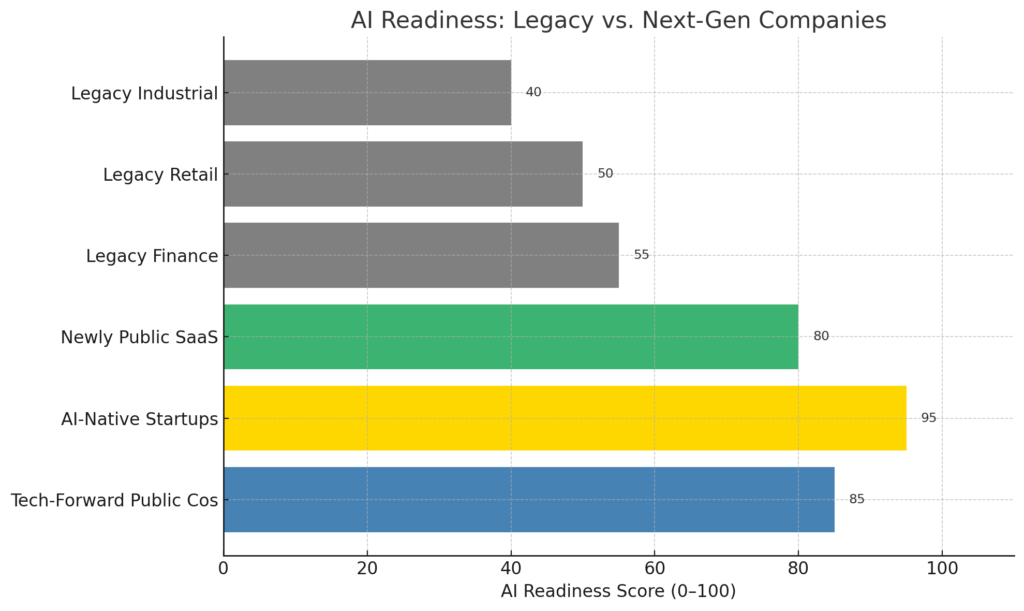

In one corner: the legacy companies. The titans. The household names still printing earnings reports in serif fonts and measuring innovation in quarters, not milliseconds. In the other: newly public startups and venture-funded hopefuls, cheerfully throwing compute at problems and sprinkling “AI-powered” into every pitch deck like seasoning on avocado toast.

Then there’s Stargate—a SoftBank- and OpenAI-backed megafund preparing to invest up to $500 billion (yes, with a b) in AI infrastructure and companies[¹]. It’s a signal flare over Wall Street: the future’s not coming—it’s already capitalized.

And yet, the adoption gap between AI-forward and AI-fearful grows wider every week.

🏢 Old Companies, New Fears

Let’s start with the hesitation. Among many older, established companies—especially those in traditional industries like manufacturing, insurance, and retail—AI is still treated like an exotic animal: admired, cautiously studied, but not invited indoors.

Why?

- Cultural inertia.

These firms often run on processes older than their board chairs. Change isn’t just hard—it’s a threat to the way things have always worked. - Legacy systems and tech debt.

You can’t bolt AI onto a system that still uses COBOL and manual workflows without sparking an existential meltdown. - Fear of displacement.

AI triggers a turf war: Who owns the insights? Whose job gets eaten? Which sacred KPI gets disrupted? - Regulatory confusion.

Many executives cite “AI governance concerns,” but what they really mean is: we don’t want to end up on the front page of the WSJ for screwing up customer data with a rogue chatbot.

As one CIO at a Fortune 100 manufacturer said off-record:

“Everyone’s asking ‘what’s our ChatGPT strategy?’ but no one wants to be the first to find out we didn’t read the fine print.”

🚀 Meanwhile, the Startups Are Already Flying

Compare that to newly public companies—or even those prepping for IPOs—and the difference is striking.

These firms:

- Are born cloud-native

- Have data cultures from Day One

- Hire machine learning engineers before hiring middle managers

- Treat AI not as a tool but a business model layer

They’re not just using AI to optimize—they’re using it to build entirely new categories.

Take companies like UiPath (automation), C3.ai (enterprise AI platforms), and the incoming crop of AI-native vertical SaaS plays. They’re not just talking about AI—they are AI. Investors know it. Analysts know it. Boards know it.

As BlackRock’s Larry Fink noted in his 2024 letter to CEOs:

“The companies that succeed in the coming decade will not just use AI—they will be defined by it.”[²]

💸 Enter Stargate: The Megafund of the Machine Era

And then there’s Stargate, the investment vehicle co-backed by OpenAI and SoftBank, reportedly raising up to $500 billion to pour into AI infrastructure, hardware, and ecosystem players[¹].

This is not your average VC round.

This is capital mobilization on the scale of the space race, except instead of rockets, we’re building reasoning machines. And instead of NASA, it’s NVIDIA, TSMC, and cloud hyperscalers racing to dominate.

Stargate isn’t just betting on AI—it’s rearchitecting capitalism around it.

And guess who’s first in line to benefit? Not the Fortune 100s still running risk assessments on GPT-4. It’s the nimble, newly public, AI-native disruptors—companies who’ll happily trade 5% EBITDA for 500% compute elasticity.

🧠 So Why Are Legacy Companies Still Dragging Their Feet?

Let’s give some grace. It’s not easy to pivot a $30 billion legacy brand overnight. But many older companies have made three critical miscalculations:

- They think AI is about tools.

It’s not. It’s about operating models and decision velocity. - They think waiting reduces risk.

In reality, waiting is the risk. The cost of inaction compounds. Your competitors aren’t standing still. They’re feeding models. - They think AI will disrupt others, not them.

(Spoiler: It will disrupt everyone—just unevenly.)

🛠️ What Forward-Thinkers Are Doing Right

Forward-thinking companies, whether startup or stalwart, are adopting AI the right way:

- Starting with data infrastructure, not AI buzz

- Redefining job roles, not just automating them

- Integrating AI into core workflows—not as a layer, but as a lens

- Embracing AI literacy across the org—not just in IT

These are the companies attracting capital, press, and talent. They aren’t afraid of AI—they’re afraid of being average.

As Sequoia Capital put it in their 2024 AI memo:

“The difference between AI-powered and AI-aware will define the market’s winners and the headlines’ losers.”[³]

TL;DR

Old-school companies are still hedging. IPO-bound startups are sprinting. Meanwhile, Stargate and its half-trillion-dollar war chest are reshaping the landscape in real time.

The companies that hesitate will be overtaken by the ones that automate. And investors? They’re already placing their bets on boldness.

The AI train isn’t arriving. It’s already departed. And it doesn’t care whether your board approved the ticket.

📚 Bibliography

- Financial Times – “OpenAI and SoftBank Back New $500 Billion AI Investment Fund,” 2024

- Larry Fink – BlackRock Annual Letter to CEOs, 2024

- Sequoia Capital – “AI and the New Business Stack,” 2024

- Gartner – “2025 CIO Agenda: AI, Risk, and Reinvention,” Dec 2024

- Harvard Business Review – “Why Legacy Companies Struggle With AI Adoption,” Oct 2023

#ThoughtLeadershipArchitect #AIAdoptionGap #StargateAI #LegacyVsNextGen #SoftBankAI #FutureOfWork #AIInEnterprise #InvestmentTrends2025 #DigitalTransformation #CIOWatchlist #THEBRILLIANTMARGINTM #AI

Leave a Reply